Similar to Japan’s devastating 80% market crash in the 1990s, China’s economy is about to experience the biggest crash in history that will take decades to recover from.

Japan’s market crash culminated in a massively inflated asset price bubble which lasted from 1986 through 1991 in which real estate and stock market prices were greatly inflated. Three decades after the Japanese market crash, the country still has not recovered from its highs.

Based on current economic indicators, the crash in Japan will pale in comparison to what’s about to happen in China. Many experts say the crash in China has already occurred but that we have yet to see the full devastating consequences of the government’s attempt to deflate the real-estate bubble without bursting it. Just as the 2008 financial crisis was years in the making, China’s crash may take months or possibly even years to fully develop.

China’s economic growth has been remarkable over the past several years, property prices have continually risen, and investors have piggybacked off that growth by investing heavily in real estate.

China’s real estate sector is massive. According to Goldman Sachs Group Inc., the total value is double the US residential housing market hitting $52 trillion in 2019. The real estate market accounts for nearly a third of China’s gross domestic product (GDP.)

Building standards are terrible in China, but that doesn’t really matter to most investors there. Despite how horribly built a structure is in China, it was almost guaranteed to be worth more later.

In the western world, when someone purchases an apartment complex, the goal is to rent out the available units and keep them occupied as long as possible. In China, investors who buy apartments don’t usually live in them or even intend to rent them out.

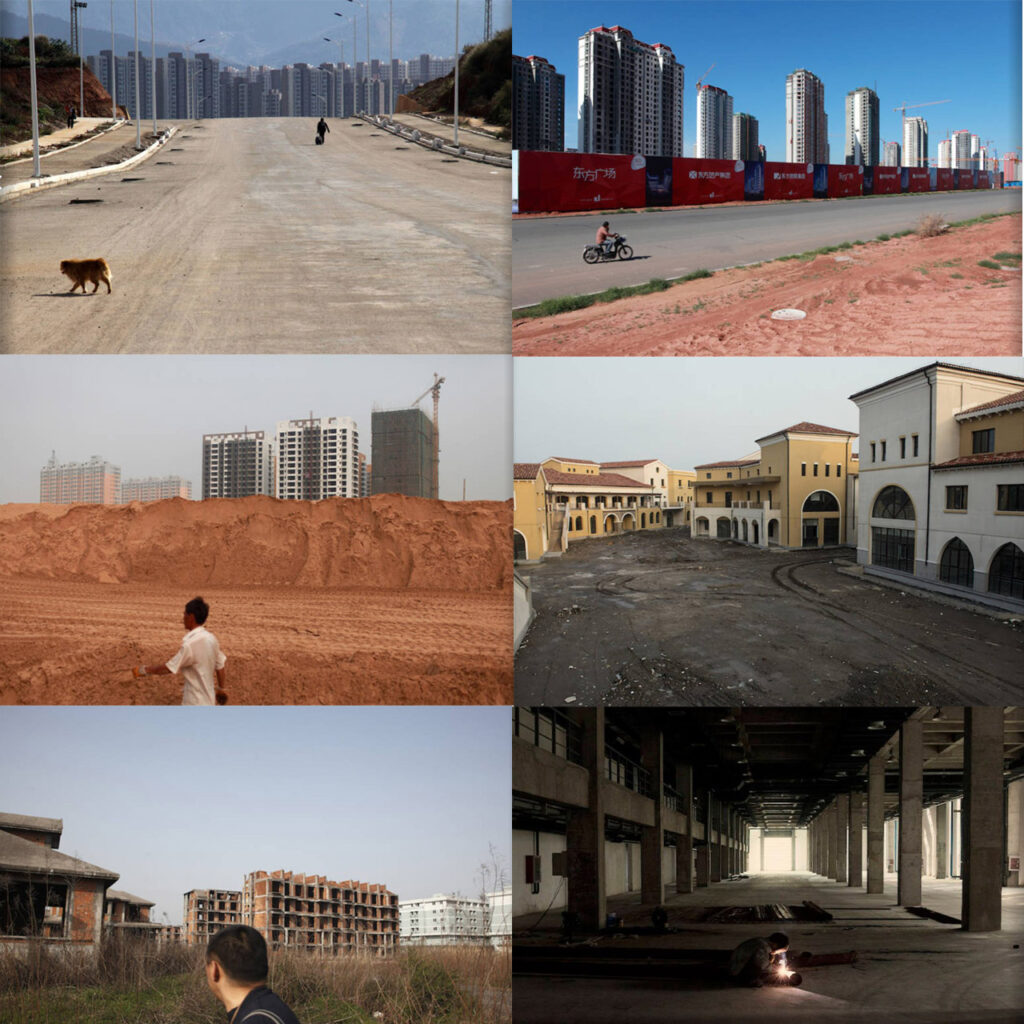

Built poorly and lived in by seemingly no one, China’s so-called ghost cities became the subject of fascination for nearly a decade. There are currently enough empty houses in China to house the entire population of France.

“In places called ghost cities you find massive, ambitious urbanizing projects that spark investment but don’t draw population,” says Max Woodworth, an associate professor of geography at Ohio State University.

These cities were built by local property developers and the government with no intention of ever having anyone living in them. The empty structures that line the boulevards of these ghost cities were meant to be sold to an investor at a profit who would also let them sit vacant accruing value in order to sell them later.

Real estate investments for years were always a sure investment in China. The country’s economy has doubled in size every few years, and because of this, investors have no problem paying a few million for a run-down apartment.

On an individual investor basis, one of the factors that helped to fuel their bubble was the fact that people in China don’t really have anything to invest in besides real estate. In China is extremely difficult to invest in stocks or shares and it is nearly impossible to invest in alternative assets like cryptocurrency.

Another factor driving the boon is the societal pressure to own a home. This societal pressure surely exists in the western world as well, but for Chinese people, it is tenfold.

Thanks to the one-child policy, China has a large population imbalance, with men outnumbering women by 33 million. By just owning property, a male’s social status can be automatically elevated in mainland China. According to a Sharpen Research Institute survey, over 60% of women in China’s major cities believe a house is necessary before tying the knot.

By just owning property, a person’s general social status can be heightened substantially. The Chinese strongly believe in generational investments, and property is a safe and lasting asset to pass down for generations to come.

Property accounts for 70% of China’s household wealth, and real estate has generated the highest number of billionaires in the country.

Another factor driving the bearish market is the Hukou system that has existed in China since 1958.

The Hukou system tracks where people’s primary residence is and from that decides the location from which they will have access to healthcare and public education for their children.

Even though there has been a massive amount of internal migration of rural workers into urban centers in China seeking higher wages, these migrant workers are still technically residents of their smaller villages. The Hukou system denies them access to better public services in the bigger cities and their children are not allowed to attend school in those places either.

This issue is the driving force behind the plight of China’s “left-behind” children. There are about 31 million children who have been left behind in their hometowns, usually in the care of relatives, while both of their parents work elsewhere. The solution to this problem for some is to buy a small one-bedroom apartment somewhere on the outskirts of the city while living in it with several other people in order to afford to cost.

China’s enthusiasm for real estate has been so high that some provincial governments have made moves to limit the amount of real estate a single household can own. One loophole certain investors have used is to get divorced on paper so they can double their holdings.

Under current rules, a family buying a second home is required to put a down payment of up to 70% while a first-time buyer needs to put only 30% down. A paper divorce has been a way to circumvent the current restrictions, allowing one of the recently divorced partners to qualify for the lower downpayment.

According to the Wall Street Journal, another way China is trying to tame the market is by reigning in China’s central bank. The People’s Bank of China was never actually independent, but it has enjoyed a special status as it has worked for years to establish credibility among investors, at home and abroad.

The Chinese government has made several attempts to cool the real estate market, like high deposit requirements for second properties, new property taxes, investment limits, and even more recently taking the collection of land sales income from local governments. These land rights sales have made up a significant portion of total government revenue. Just last year, these agreements generated around ¥8 trillion.

Year over year, China’s housing market continued to soar with house price growth hitting record highs in both tier 1 and tier cities. But this tower of cards is about to come tumbling down, and it may take the whole world with it.

Many developers have grown desperately short of cash since President Xi Jinping last year unveiled the “three red lines” policy, imposing limits on liabilities-to-assets, net debt-to-equity, and cash-to-short-term borrowing ratios.

According to a Reuters report from November, revenue from land sales has plummetted for four months straight, as cash-strapped developers have become more cautious on land purchases after tighter regulatory curbs on new borrowing.

The BBC recently reported that new home prices in China saw their biggest month-on-month decline since 2015, and new construction starts from January to October also fell 7.7%, compared to a year earlier.

Chinese developer, China Evergrande Group, has defaulted for the first time on dollar debt. The developer is the most indebted real estate developer in the world and the most indebted company in China. Evergrande owes money to lenders, suppliers, and foreign investors. The company also owes unfinished apartments to home buyers and has racked up more than $300 billion in unpaid bills.

Long considered too big to fail by investors, Evergrande has become the largest casualty of President Xi Jinping’s campaign to reign in the country’s overindebted and overheated property market.

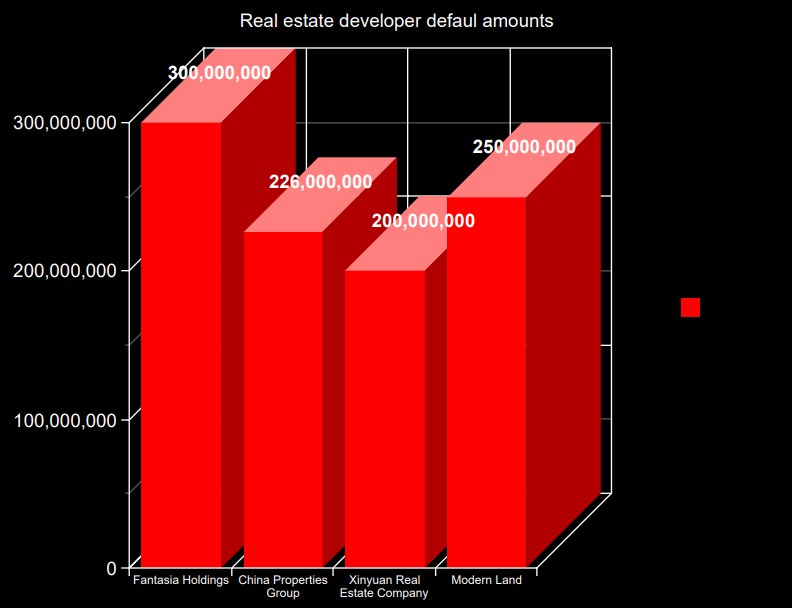

This pattern is evident with other Chinese real estate companies including Fantasia holdings, Modern Land, China Properties Group, and Xinyuan Real Estate Co. All of them have failed to pay hundreds of millions worth of debt.

During this Chinese bull run, developers took out over 5 trillion worth of debt, and according to Goldman Sachs Group Inc., over 6 billion of real estate development debt is due in January of 2022. Only 2 billion of that debt has been paid to date.

When leverage like this is in the market, a crash is almost always certain and similar to what happened to Japan in the 1990s. A crash like Japan’s would not only affect the citizens of China, but also the entire global economy.

Around 70% of China’s household wealth is tied up in the real estate market. If the real estate market crashes to the level Japan’s market did, the entire global economy would freeze.

The global commodity market is also extremely dependent on China and China’s demand for commodities represents 15% of the entire global gross domestic product (GDP.) Commodities like Iron and copper almost completely depend on China alone.

According to Reuters, the price of Iron has fallen more than 50% since May. The steelmaking ingredient in the top steel producing country of China could fall to $75 a ton by the end of 2022 according to Westpac senior economist Justin Smirk.

While still very high by historical standards, Copper prices are down around 15% in the same time period. Declining commodity prices are usually beneficial to all companies worldwide as cheaper raw materials usually lead to higher profits. However, large declines in commodity prices are a key indicator that China’s economy is screeching to a halt.

The Federal Reserve said in its latest financial stability report, that China’s real estate troubles could spill over to the U.S.

“Stresses in China’s real estate sector could strain the Chinese financial system, with possible spillovers to the United States.”

The Federal Reserve also said that given the size of China’s economy and financial system as well as its extensive trade linkages with the rest of the world, financial stresses in China could strain global financial markets through a deterioration of risk sentiment. They say that it could also dramatically pose risks to global economic growth and affect the United States.

At the same time this is happening abroad, President Joe Biden may be looking for a bailout from the Federal Reserve as inflation spirals out of control.

According to a CNBC report from early December, inflation has surged to 6.8% in November. Year-over-year, inflation rose to 6.2 percent in October, the highest rate in over 30 years, and overall annual inflation has hit the highest rate since 1982.

“Inflation accelerated at its fastest pace since 1982 in November, the Labor Department said Friday, putting pressure on the economic recovery and raising the stakes for the Federal Reserve… Energy prices have risen 33.3% since November 2020, including a 3.5% surge in November. Gasoline alone is up 58.1%… Food prices have jumped 6.1% over the year, while used car and truck prices, a major contributor to the inflation burst, are up 31.4%, following a 2.5% increase last month… Shelter costs, which comprise about one-third of the CPI, increased 3.8% on the year, the highest since 2007 as the housing crisis accelerated.”

According to The Labor Department, the increases for food and energy were the fastest 12-month gains in at least 13 years.

Central banks have indicated that will begin slowing the help they’re providing in an effort to tamp down inflation, and investors expect the Fed to double the ‘tapering’ of its asset purchases to $30 billion a month starting in January.

It is widely expected that the Fed will start raising interest rates as soon as next spring to help calm the bubble.

Following the pandemic, the US government made an effort to stimulate the economy by issuing stimulus checks to millions of employed Americans. The government had to borrow by selling its debt in the form of U.S. Treasury bonds and other types of securities in order to obtain the money needed for the stimulus packages.

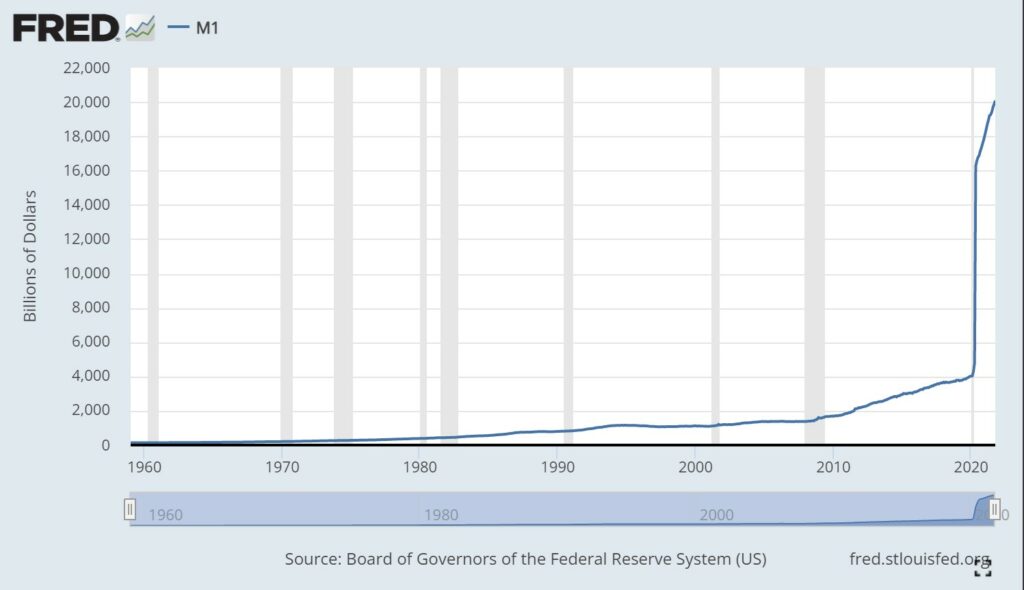

Following the sale of the bonds, the Federal Reserve got to work printing money. While the BLS reports on inflation, the Fed moderates inflation and employment rates by managing the supply of money and setting interest rates.

While the printing of money is nothing new, this was the first time in history that over 45% of US dollars in existence was printed in the last 12 months alone by the end of May 2021.

Central bank officials indicated recently that they’re ready to begin “tapering” which is a process of gradually trimming the Fed’s purchases of Treasuries and government-guaranteed mortgage-backed securities. The hope is to wean the economy slowly off the stimulus provided by the purchases during the pandemic to avoid a crash landing.

While the Fed has gone into policy retreat many times before, it has never had to pull back from such a dramatically accommodative position.

According to a recent CNBC report, CEOs and other investors may have some insider information as to what is to come in the market.

Microsoft’s Satya Nadella, Amazon’s Jeff Bezos, Tesla’s Elon Musk, as well as other CEOs and insiders have been cashing in their stock at the highest pace on record. As of Monday, their sales are up 30% from 2020 to $69 billion, and up 79% versus a 10-year average. CEOs and corporate insiders have sold a record number of shares in 2021.

Meanwhile, the International Monetary Fund (IMF) recently warned that economic collapse in low-income nations is now inevitable unless creditors in first-world nations suspend debt obligations and renegotiate new terms.

For some creditors, debt-for-nature swaps are one way to help ease debt obligations. This process is where a creditor country forgives a portion of the public bilateral debt of a debtor nation in exchange for environmental commitments from that country.

The New York Times reported in early December that Afghanistan’s economy is on the brink of collapse and that the crisis could result in more than half of the population facing life-threatening levels of food insecurity.

The UN says that 4 million children are out of school and 9 million more will be soon as 70% of teachers haven’t been paid since August.