Caroline Downey

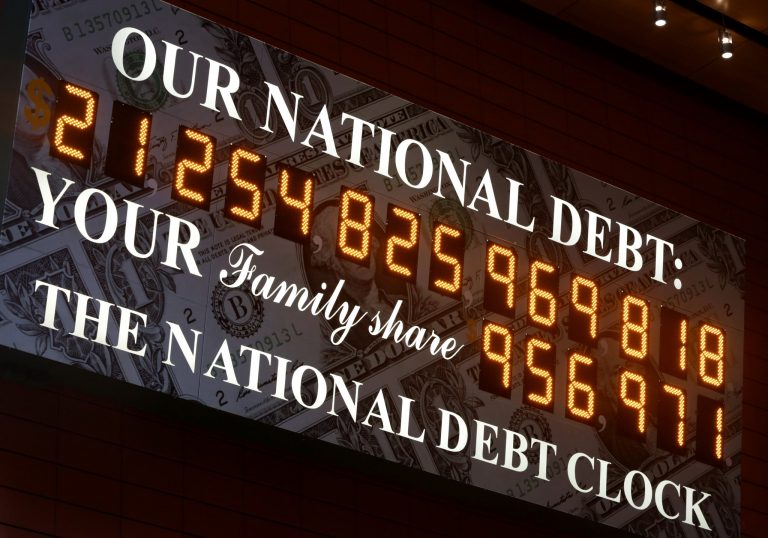

The U.S. national debt hit and exceeded $30 trillion for the first time in the country’s history Tuesday, Treasury Department data confirmed.

The ballooning debt is largely attributed to the massive social spending prompted by the Covid-19 pandemic. Since the end of 2019, the national debt grew by an astonishing $7 trillion. The announcement comes as the Fed is expected to raise interest rates as early as March to curb inflation and an over-heating economy plagued by supply and demand imbalances. The Fed’s likely move will be the first series of hikes since 2015 and will, by default, increase borrowing costs for the U.S. to finance its debt.

Both monetary and fiscal stimulus have been through the roof for the two-year and ongoing Covid-19 crisis. As of December, 80 percent of all US dollars in existence were printed in the previous 22 months. Starting at $4 trillion in January 2020, the debt exploded to $20 trillion in October 2021.

After many months of accelerating quantitative easing, or large-scale asset purchases that inject trillions of dollars into the economy, Federal Reserve Chair Jerome Powell indicated last week that the central bank will start unloading its balance sheet and reversing its accommodative monetary policy.

The previous administration also had a role to play in the expanding debt, spearheading the 2017 Tax Cuts and Jobs Act, which is projected to add $1 trillion to $2 trillion between 2018 and 2025, according to the Tax Policy Center.

However, the Biden administration has presided over an era of unprecedented spending. The current debt-to-GDP ratio is 130.65 percent, meaning the country’s gross debt is far exceeding economic output.

The federal government has nearly $8 trillion in debt obligations to foreign and international investors. America’s largest creditors are China and Japan, with the former holding 1.05 trillion U.S. dollars in U.S. securities and Japan holding 1.3 trillion U.S. dollars worth.

In October, a debacle erupted in Congress over raising the debt ceiling, posing a potential debt default emergency situation. Republicans had originally opposed increasing the debt limit out of principle, to avoid being complicit in funding the Democratic-sponsored $1 trillion infrastructure bill and even more expansive social spending program known as Build Back Better. Ultimately, the Senate passed a short-term debt ceiling extension in a compromise.

Editor’s Note: A previous version of this article incorrectly stated that the debt had surpassed $30 million rather than trillion.